Total Revenue of Rs. 7.19 lakh crore collected under GST in the period between August 2017 and March 2018 . During 2017-18, total revenue collected under GST in the period between August 2017 and March 2018 has been Rs. 7.19 lakh crore. This includes Rs. 1.19 lakh crore of CGST, Rs. 1.72 lakh crore of SGST, Rs. 3.66 lakh crore of IGST (including Rs. 1.73 lakh crore on imports) and Rs. 62,021 crore of cess (including Rs. 5702 crore on imports). For this eight months, the average monthly collection has been Rs. 89,885 crore.

While the tax on domestic supplies in a month is collected through the process of returns and gets collected in the next month, IGST and cess on imports gets collected in the same month. Therefore, during the current year, GST on domestic supplies has been collected only in eight months from August 2017 to March 2018, IGST and cess on imports has been collected for nine months, from July 2017 to March 2018. Including the collection of July 2017, the total GST collection during the financial year 2017-18 stands provisionally at Rs. 7.41 lakh crore.

The SGST collection during the year, including the settlement of IGST has been Rs. 2.91 lakh crore and the total compensation released to the States for a period of eight months during the last financial year was Rs. 41,147 crore to ensure that the revenue of the States is protected at the level of 14% over the base year tax collection in 2015-16. The revenue gap of each State is coming down over last eight months. The average revenue gap of all states for last year is around 17%.

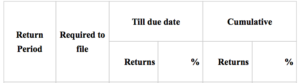

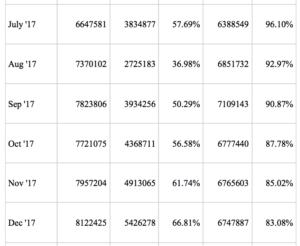

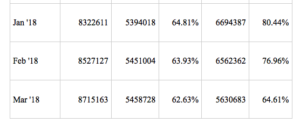

There has been a progressive improvement in the compliance level observed during the course of the year. Following table shows the percentage of returns filed as on due date and the cumulative level of compliance.

As may be seen, the compliance level as on the due date has steadily increased and, by the end of the financial year, has reached to an average of 65% from around 55-57% observed during initial months. The cumulative compliance levels (percentage of returns filed till date) for initial months has crossed 90% and for July, 2018, has reached 96%.

There are State-wise variations in the compliance level observed till due date. However, including delayed filings, the State-wise compliance levels converge over a period of time. (Data compiled from PIB)

Goods and Service Tax (GST) is an indirect tax (or consumption tax} levied in India on the sale of goods and services. GST is levied at every step in the production process, but is refunded to all parties in the chain of production other than the final consumer.

Goods and services are divided into five tax slabs for collection of tax – 0%, 5%, 12%,18% and 28%. Petroleum products and alcoholic drinks are taxed separately by the individual state governments. There is a special rate of 0.25% on rough precious and semi-precious stones and 3% on gold.[1] In addition a cess of 22% or other rates on top of 28% GST applies on few items like aerated drinks, luxury cars and tobacco products.[2] Pre-GST, the statutory tax rate for most goods was about 26.5%, Post-GST, most goods are expected to be in the 18% tax range.

The tax came into effect from July 1, 2017 through the implementation of One Hundred and First Amendment of the Constitution of India by the Modi government. The tax replaced existing multiple cascading taxes levied by the central and state governments.

The tax rates, rules and regulations are governed by the GST Council which comprises finance ministers of centre and all the states. GST simplified a slew of indirect taxes with a unified tax and is therefore expected to dramatically reshape the country’s 2.4 trillion dollar economy.[3] Trucks travel time in interstate movement dropped by 20%, because of no interstate check posts.[4]