The gross GST revenue collected in the month of April, 2022 is Rs 1,67,540 crore of which CGST is Rs 33,159 crore, SGST is Rs 41,793 crore, IGST is Rs 81,939 crore (including Rs 36,705 crore collected on import of goods) and cess is Rs 10,649 crore (including Rs 857 crore collected on import of goods).

The gross GST collection in April 2022 is all time high, Rs 25,000 crore more than the next highest collection of Rs. 1,42,095 crore, just last month.

The government has settled Rs 33,423 crore to CGST and Rs 26962 crore to SGST from IGST. The total revenue of Centre and the States in the month of April 2022 after regular settlement is Rs 66,582 crore for CGST and Rs 68,755 crore for the SGST.

The revenues for the month of April 2022 are 20% higher than the GST revenues in the same month last year. During the month, revenues from import of goods was 30% higher and the revenues from domestic transaction (including import of services) are 17% higher than the revenues from these sources during the same month last year.

For the first time gross GST collection has crossed Rs 1.5 lakh crore mark. Total number of e-way bills generated in the month of March 2022 was 7.7 crore, which is 13% higher than 6.8 crore e-way bills generated in the month of February 2022, which reflects recovery of business activity at faster pace.

Month of April 2022 saw the highest ever tax collection in a single day on 20th April 2022 and highest collection during an hour, during 4 PM to 5PM on that day. On 20th April 2022, Rs 57,847 crore was paid through 9.58 lakh transactions and during 4-5 PM, almost Rs 8,000 crore was paid through 88,000 transactions. The highest single day payment last year (on the same date) was Rs 48,000 crore through 7.22 lakh transactions and highest one hour collection (2-3PM on the same date last year) was Rs 6,400 crore through 65,000 transactions.

During April 2022, 1.06 crore GST returns in GSTR-3B were filed, of which 97 lakh pertained to the month of March 2022, as compared to total 92 lakh returns filed during April 2021. Similarly, during April 2022, 1.05 crore statements of invoices issued in GSTR-1 were filed. Till end of the month, the filing percentage for GSTR-3B in April 2022 was 84.7% as compared to 78.3% in April 2021 and the filing percentage for GSTR-1 in April 2022 was 83.11% as compared to 73.9% in April 2021.

This shows clear improvement in the compliance behaviour, which has been a result of various measures taken by the tax administration to nudge taxpayers to file returns timely, to making compliance easier and smoother and strict enforcement action taken against errant taxpayers identified based on data analytics and artificial intelligence.

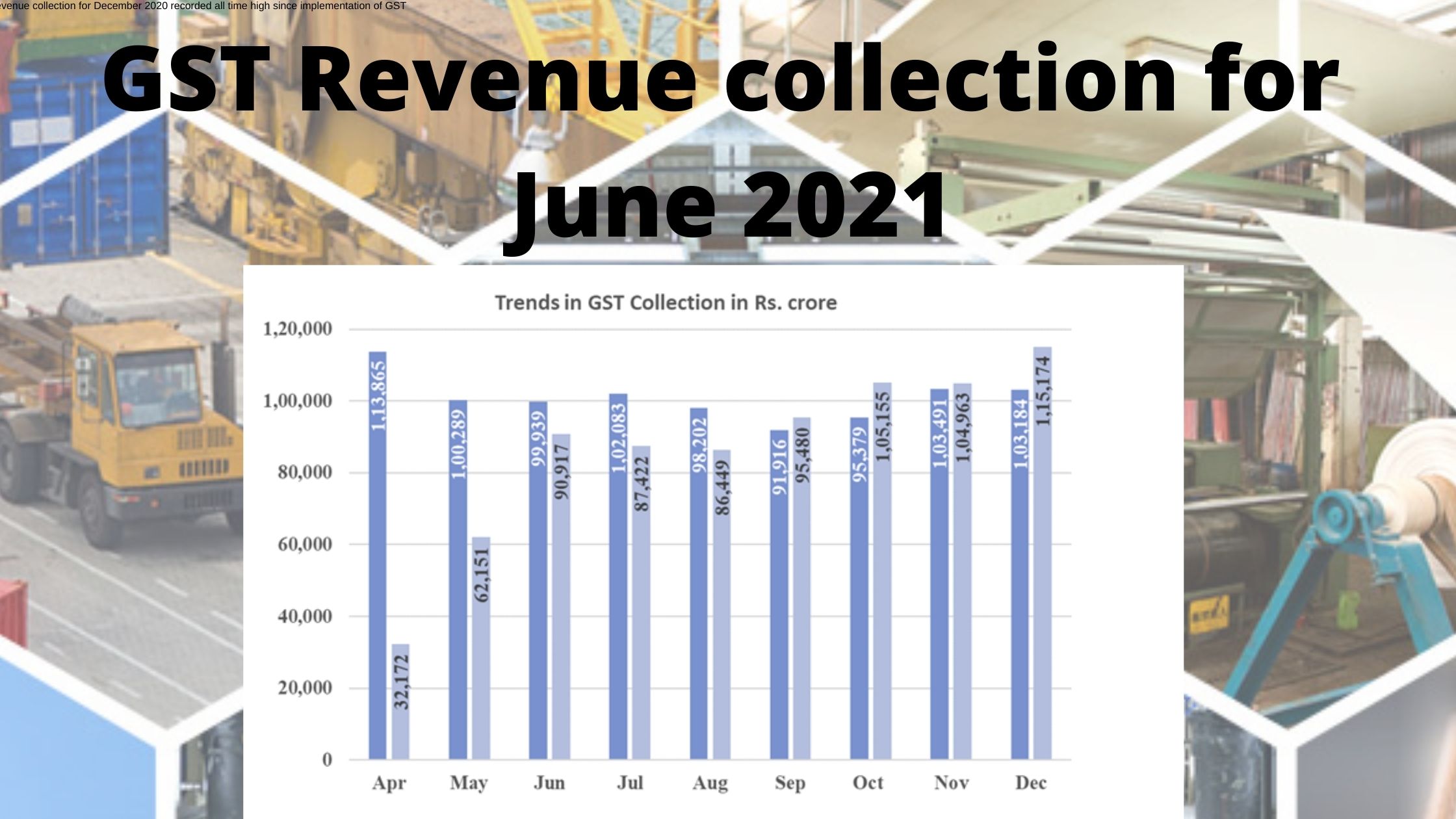

The chart below shows trends in monthly gross GST revenues during the current year. The table shows the state-wise figures of GST collected in each State during the month of April 2022 as compared to April 2021.

State-wise Growth of GST revenues during April 2022

|

State |

Apr-21 |

Apr-22 |

Growth |

|

Jammu and Kashmir |

509 |

560 |

10% |

|

Himachal Pradesh |

764 |

817 |

7% |

|

Punjab |

1,924 |

1,994 |

4% |

|

Chandigarh |

203 |

249 |

22% |

|

Uttarakhand |

1,422 |

1,887 |

33% |

|

Haryana |

6,658 |

8,197 |

23% |

|

Delhi |

5,053 |

5,871 |

16% |

|

Rajasthan |

3,820 |

4,547 |

19% |

|

Uttar Pradesh |

7,355 |

8,534 |

16% |

|

Bihar |

1,508 |

1,471 |

-2% |

|

Sikkim |

258 |

264 |

2% |

|

Arunachal Pradesh |

103 |

196 |

90% |

|

Nagaland |

52 |

68 |

32% |

|

Manipur |

103 |

69 |

-33% |

|

Mizoram |

57 |

46 |

-19% |

|

Tripura |

110 |

107 |

-3% |

|

Meghalaya |

206 |

227 |

10% |

|

Assam |

1,151 |

1,313 |

14% |

|

West Bengal |

5,236 |

5,644 |

8% |

|

Jharkhand |

2,956 |

3,100 |

5% |

|

Odisha |

3,849 |

4,910 |

28% |

|

Chattisgarh |

2,673 |

2,977 |

11% |

|

Madhya Pradesh |

3,050 |

3,339 |

9% |

|

Gujarat |

9,632 |

11,264 |

17% |

|

Daman and Diu |

1 |

0 |

-78% |

|

Dadra and Nagar Haveli |

292 |

381 |

30% |

|

Maharashtra |

22,013 |

27,495 |

25% |

|

Karnataka |

9,955 |

11,820 |

19% |

|

Goa |

401 |

470 |

17% |

|

Lakshadweep |

4 |

3 |

-18% |

|

Kerala |

2,466 |

2,689 |

9% |

|

Tamil Nadu |

8,849 |

9,724 |

10% |

|

Puducherry |

169 |

206 |

21% |

|

Andaman and Nicobar Islands |

61 |

87 |

44% |

|

Telangana |

4,262 |

4,955 |

16% |

|

Andhra Pradesh |

3,345 |

4,067 |

22% |

|

Ladakh |

31 |

47 |

53% |

|

Other Territory |

159 |

216 |

36% |

|

Center Jurisdiction |

142 |

167 |

17% |

|

Grand Total |

1,10,804 |

1,29,978 |

17% |