| 2017-18

(Actuals) |

2018-19

(Revised Estimates) |

2019-20

(Budget Estimates) |

|

| Revenue Receipts

(Like Income Tax, GST, Dividends from PSU’s & Banks ,Interest on Government Lending Etc.) |

14,35,233 Cr. | 17,29,682 Cr. | 19,77,693 Cr. |

| Capital Receipts

(Recovery of Loans, Funds Raised from PPF, small saving deposits etc.) |

7,06,742 Cr. | 7,27,553 Cr. | 8,06,507 Cr. |

| Total Receipts

(Revenue + Capital)

|

21,41,975 Cr. | 24,57,235 Cr. | 27,84,200 Cr. |

| Revenue Expenditure

(Like Salaries to Government Employees, Pension, Subsidies, Grants, interest payments on loans taken by the Government of India) |

18,78,835 Cr. | 21,40,612 Cr. | 24,47,907 Cr. |

| Capital Expenditure

(Like Expenditure on building Roads, Flyovers, Hospitals, factories Etc.) |

2,63,140 Cr. | 3,16,623 Cr. | 3,36,293 Cr. |

| Total Expenditures

(Revenue + Capital)

|

21,41,975 Cr. | 24,57,235 Cr. | 27,84,200 Cr. |

| Revenue Deficit | 4,43,602 Cr. | 4,10,930 Cr. | 4,70,214 Cr. |

| Fiscal Deficit | 5,91,064 Cr. | 6,34,398 Cr. | 7,03,999 Cr. |

| Primary Deficit | 62,112 Cr | 46,828 Cr. | 38,938 Cr. |

Revenue Deficit – A revenue deficit occurs when realized net income is less than the projected net income. This happens when the actual amount of revenues and / or the actual amount of expenditures do not correspond with budgeted revenues and expenditures.

Fiscal Deficit – Fiscal deficit is defined as excess of total budget expenditure over total budget receipts excluding borrowings during a fiscal year. In simple words, it is amount of borrowing the government has to resort to meet its expenses. A large deficit means a large amount of borrowing.

Primary Deficit – Primary deficit refers to difference between fiscal deficit of the current year and interest payments on the previous borrowings. Primary Deficit = Fiscal Deficit – Interest Payments.

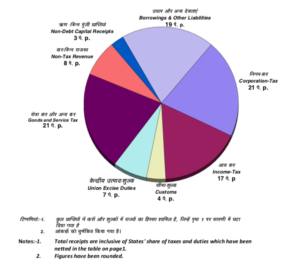

Source of Funds – Rupees Comes From

Application of Funds – Rupee Goes to

Proposed Amendment in Income Tax

- No change in Rates of Income Tax and Income Tax Slabs –

| Sr. No. | Slab wise Income (in Rupees) | Tax + Income Tax Rate |

| 1. | 0 – 2,50,000 | NIL |

| 2. | 2,50,000 – 5,00,000 | 5% |

| 3. | 5,00,000 – 10,00,000 | 12,500 +20% |

| 4. | Above 10,00,000 | 1,12,500 + 30% |

For Senior Citizens (who is of the age of Sixty years or more but less than eighty years at any time during the previous year)

| Sr. No. | Slab wise Income (in Rupees) | Tax + Income Tax Rate |

| 1. | 0 – 3,00,000 | NIL |

| 2. | 3,00,000 – 5,00,000 | 5% |

| 3. | 5,00,000 – 10,00,000 | 10,000 +20% |

| 4. | Above 10,00,000 | 1,10,000 + 30% |

For Super Senior Citizens (who is of the age of Eighty years or more at any time during the previous year)

| Sr. No. | Slab wise Income (in Rupees) | Tax + Income Tax Rate |

| 1. | 0 – 5,00,000 | NIL |

| 2. | 5,00,000 – 10,00,000 | 20% |

| 4. | Above 10,00,000 | 1,00,000 + 30% |

Surcharge on Income Tax

| Sr. No. | Slab wise Income (in Rupees) | Rate of Surcharge |

| 1. | 50 Lakhs – 1 Crore | 10% |

| 2. | Above 1 Crore | 15% |

- Individual taxpayers having taxable annual income up to Rs.5 lakhs will get full tax rebate and therefore will not be required to pay any income tax. As a result, even persons having gross taxable income up to Rs. 6.50 lakhs may not be required to pay any income tax if they make investments in provident funds, specified savings, insurance etc. In fact, with additional deductions such as interest on home loan up to Rs. 2 lakhs, interest on education loans, National Pension Scheme contributions, medical insurance, medical expenditure on senior citizens etc, persons having even higher income will not have to pay any tax. This will provide tax benefit of Rs. 18,500 crore to an estimated 3 crore middle class taxpayers comprising self employed, small business, small traders, salary earners, pensioners and senior citizens.

- Standard Deduction U/s 16 of the Income Tax Act, for salaried individual has been increased from Rs.40,000 to Rs.50,000.

- Bill seeks to amend section 23 of the Income-tax Act so as to provide relief to the taxpayer by allowing him an option to claim nil annual value in respect of any two houses, declared as self-occupied, instead of one such house as currently provided. It further seeks to provide relief to the taxpayers that notional rent in respect of unsold inventory shall not be charged to tax up to two years, instead of existing one year, from the end of the financial year in which the certificate of completion is obtained from the competent authority.

- Bill seeks to amend section 24 of the Income-tax Act to provide that the monetary limit of deduction on account of interest payable on borrowed capital shall continue to apply to the aggregate of the amounts of deduction in case of more than 1 (one) self-occupied houses.

- Currently, income tax on notional rent is payable if one has more than 1 (one) self-occupied house. Considering the difficulty of the middle class having to maintain families at two locations on account of their job, children’s education, care of parents etc. Bill seeks to exempt levy of income tax on notional rent on a second self-occupied house.

- Bill seeks to amend section 54 of the Income-tax Act so as to provide relief to the taxpayers having long-term capital gains up to Rs. 2 Cr. (two crore rupees), arising from transfer of a residential house, by affording the assessee a one time opportunity, at his option, to utilise the said amount for the purchase or construction of 2 residential houses in India instead of 1 (one) residential house as currently provided.

- Bill seeks to amend section 80-IBA of the Income-tax Act so as to augment the supply of affordable houses by extending the time limit from 31st March, 2019 to 31st March, 2020 for obtaining approval of the housing project for availing deduction.

- Bill seeks to amend section 194A of the Income-tax Act so as to ease the burden of compliance by way of increasing the threshold limit from Rs. 10,000 (ten thousand rupees) to Rs. 40,000 (forty thousand rupees), for deduction of tax at source on interest income, other than interest on securities, paid by a banking company, co-operative society or a post office.

- Bill seeks to amend section 194-I of the Income-tax Act to rationalize the threshold limit from Rs. 1,80,000 (one hundred and eighty thousand rupees) to Rs. 2,40,000 (two hundred and forty thousand rupees, for deduction of tax at source on rental income).

- Group of Ministers to suggest ways to reduce GST for house buyers.

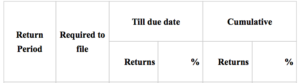

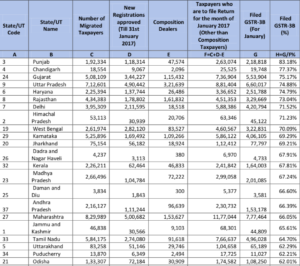

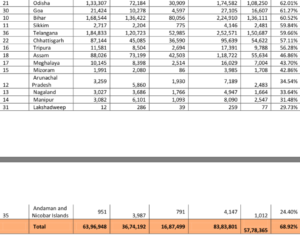

- Businesses with less than Rs 5 crore annual turnover, comprising over 90% of GST payers, will be allowed to file quarterly GST returns – GST aims to benefit small traders, manufacturers and service providers. Exemptions from GST for small businesses has been doubled from Rs. 20 lakh to Rs. 40 lakh. Further, small businesses having turnover up to Rs.1.5 crore have been given an attractive composition scheme wherein they pay only 1% flat rate and have to file one annual return only. Similarly, small service providers with turnover upto Rs. 50 lakhs can now opt for composition scheme and pay GST at 6% instead of 18%. More than 35 lakh small traders, manufacturers and service providers will benefit from these trader friendly measures. Soon, businesses comprising over 90% of GST payers will be allowed to file quarterly return.

- Companies, too, require Aadhar card. Government of India will soon formulate a policy to offer Unique ID for companies across the nation.

- The target for disinvestment for FY 2019 is ₹80,000

- United Assurance, National Insurance and Oriental Insurance will now be merged into a single entity and would also be listed.

- The target for disinvestment for FY 18 has been revised to ₹1 lakh crore.

- With a view to promote ‘Make in India’ campaign, the Government has made imported products costlier. Here are the key highlights:

- Custom Duty on electronics, such as, television and smartphones has been increased.

- 10% surcharge is applicable on imported goods on account of social welfare charge.

- Central Board of Excise and Customs (CBEC) has been renamed as Central Board of Indirect Taxes and Customs (CBITC).

- Solar tempered glass has exempted from custom duty, if the same is being used to manufacture solar cells.

- Importing crude vegetable oil will now attract a custom duty of 30% (earlier it was 12.5%). On the other hand, importing refined vegetable oil will attract a custom duty of 35% (earlier it was 20%).

- Products such as bus and truck tyres, sunglasses, furniture, etc., will attract a higher custom duty.

- Jewellery will attract a custom duty of 20% (earlier it was 15%) and watches will attract a custom duty of 20% (earlier it was 10%).

- Imported TV parts (LCD, LED, etc.) will now be taxed at 15%. Footwear, wearable electronics gadgets will be taxed at 20%.

- Government seeks to safeguard the interest of angel investors and venture capitalists.

- SEBI to implement a new rule that requires corporations to reserve 1/4th of their debt needs.

- SEBI to instruct companies to meet 25% of their debt from bond market.

This year’s budget has been focused upon providing higher income opportunities for the farmers. For achieving this objective, Government plans to help farmers producing more at a lesser price. Currently, the agricultural output for India is at a record high with 275 million tonnes of food grains. Fruits and vegetables have been produced at a scale of 300 million tonnes. Government plans to keep a profit of 1.5 times for the farmers. Here are the key highlights:

- Setting up of ₹2000 crore fund to improve the connection between market and agricultural fields.

- Operation Green, an initiative to promote agricultural products, to be launched at a cost of ₹500 crore.

- Kisan credit now available to animal husbandry and fishery sector.

- 10,000 crore allocated to Fisheries and Aquaculture Development.

- 10,000 crore allocated to animal husbandry infrastructure development fund.

- 1,200 crore allocated towards restricting of bamboo forests.

- Target for Agricultural Credit extended to ₹11 lakh crore (earlier it as ₹8.5 crore)

- Special scheme introduced to manage crop reduce in high pollution areas like Delhi, Haryana and Punjab.

- 3073 crore allotted to Digital India campaign. The amount has doubled from last year.

- 10000 crore has been allocated towards offering 5 lakh WiFi hotspots. This will serve 5 crore people in the rural India.

- Crypto currency such as Bitcoin is illegal. The Government will take measure to curb its trading in India.

- Block chain Technology to be one of the areas of focus for technology development in India.

- Public banks, with the aid of recapitalization, will now be able to lend an additional amount of ₹5 lakh crore.

- The textile industry has been allocated ₹7148 crore for its development.

With a view to develop the rural economy, this year’s budget covered the following:

- New LPG connection to 8 crore women who are below the poverty line.

- New power connection to 4 crore people under PM Saubhagya Yojana.

- The allocated budget for PM Saubhagya Yojana is ₹16,000 crore.

- Construction of 2 crore toilets across India by 2019 under Swachh Bharat Abhiyan

- By 2022, everyone in India will have a home. Currently 51 lakh affordable

Home in rural areas have been constructed along with 50 lakh homes in Urban areas.

- Rural areas to get 1 crore homes under Pradhan Mantri Awas Yojana.

- 5,750 crore to be allocated to National livelihood scheme.

- 9,975 crore allocated to Social Security Scheme for next year.

This year’s budget has laid special importance to the education sector. With emphasis being on digital technology, Finance Minister, Arun Jaitley, said that technology is the biggest driver in improving quality of education that children get these days. Here are the key highlights:

- 1 lakh crore allocated towards upgrading education sector.

- Eklavya Schools to be setup in every block where more than 50% of the population belongs to ST by 2022.

- Black board to be replaced by digital boards in all schools by 2022.

- PM Research fellows introduced. 1000 Btech candidates to be identified each year by the Government. The selected candidates will get a chance to pursue PHD from IIT and IISc. The candidates would also teach undergraduates once a week.

Covering the health sector, here are the key highlights:

- Around 1200 crore homes would be offered healthcare facility through Aayushman Bharat programme. With 1.5 lakh centres spread across India, this facility would reach to a wide section of people.

- World’s largest Government funded healthcare programme has been launched. Flagship National Healthcare Protection Scheme aims at offering ₹5 lakh per family in respect of secondary and tertiary care in hospitals. There are around 50 crore beneficiaries in this program.

- 600 crore has been allocated to patients suffering from tuberculosis. They are subject to receive ₹500 per month during the treatment period.

- One medical college to be set up for every three parliamentary constituencies. In total there will be 24 new Government Medical Colleges along with improving the existing ones.

Social Security has always been a key aspect of the Budget. The existing PM Jivan Bima Yojana has been benefiting more than 5.22 crore families in India. Additionally, there are few more hey highlights that were mentioned in the budget.

- Sukanya Samriddhi Yojana now has 1.26 crore accounts.

- 52,719 has been offered under Social Inclusion Scheme for Schedule Castes

- 39,139 has been offered under Social Inclusion Scheme for Schedule Tribes

- 4.6 lakh crore allotted to MUDRA scheme

- 3 lakh crore is the target for Mudra Yojana

- Unbranded diesel gets cheaper by ₹2 as excise has been reduced. The effective rate now stands at ₹6.33/ltr.

- Unbranded petrol gets cheaper by ₹2 as excise has been reduced. The effective rate now stands at ₹4.48/ltr.

- Government to sponsor 12% of the wages towards EPF for all sector. The scheme is available for new employees and the funding will take place only for the first three years.

- EPF contribution for women has been reduced to 8%; valid only for the first 3 years.

- New tunnel to be constructed in Sera Pass for boosting the tourism industry.

- 99 cities have already been selected out of 100 smart cities. The cities will avail facilities worth ₹2.04 lakh crore.

- Private funding along with branding and marketing will help the Government to promote 10 prominent tourist destinations in the country.

- Pay-as-you-use system introduced by the Government for dealing with toll payments.

- Bharatmala project is introduced. The project includes developing 35,000 Kms with a budget of ₹5.35 lakh crore. This section is only Phase 1 of the total project.

- 1.48 lakh crore for Railways sector. Previously, it was ₹1.31 lakh crore.

- Escalators to be mandatory in stations where footfall is greater than 25,000 per day.

- Number of station with Wi-fi and CCTVs to increase.

- Elimination of 4267 unmanned rail crossing by 2020.

- 11000 crore allocated to Mumbai rail network and ₹17,000 crore allocated for Bengaluru metro network.

- 17,000 crore allocated towards development of railway network in suburban regions of Bengaluru.

- Number of airports under AAI to increase by 5 times with 1 billion trips every year. Currently, there are 124 airports under AAI. The allocated budget is Rs. 60 crore.

- Unconnected airports to be linked with all other airports through UDAN Scheme.

- Defence has been allocated with ₹2.82 lakh crore. In the previous year, this segment was allotted ₹2.67 lakh crore.

- Food subsidy increases to ₹1.69 lakh crore for the year 2018-19. Earlier, food subsidy was ₹1.4 lakh crore

- Increase in Emoluments: Governors – ₹3.5 lakh, Vice President – ₹4 lakh, President – ₹5 lakh.

- Emoluments for Parliamentarians have also increased based on index to inflation.

- Rs. 150 crore for honouring 150th birth anniversary of the Father of the Nation, Mahatma Gandhi.