Question 1. What is GST? How does it work?

Answer: GST is one indirect tax for the whole nation, which will make India one unified common market. GST is a single tax on the supply of goods and services, right from the manufacturer to the consumer. Credits of input taxes paid at each stage will be available in the subsequent stage of value addition, which makes GST essentially a tax only on value addition at each stage. The final consumer will thus bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages.

Question 2. What are the benefits of GST?

Answer: The benefits of GST can be summarized as under:

For business and industry –

- Easy compliance: A robust and comprehensive IT system would be the foundation of the GST regime in India. Therefore, all tax payer services such as registrations, returns, payments, etc. would be available to the taxpayers online, which would make compliance easy and transparent.

- Uniformity of tax rates and structures: GST will ensurethat indirect tax rates and structures are commonacross the country, thereby increasing certainty and ease of doing business. In other words, GST would make doing business in the country tax neutral, irrespective of the choice of place of doing business.

- Removal of cascading: A system of seamless tax-credits throughout the value-chain, and across boundaries of States, would ensure that there is minimal cascading of taxes. This would reduce hidden costs of doing business.

- Improved competitiveness: Reduction in transaction costs of doing business would eventually lead to an improved competitiveness for the trade and industry.

- Gain to manufacturers and exporters: The subsuming of major Central and State taxes in GST, complete and comprehensive set-off of input goods and services and phasing out of Central Sales Tax (CST) would reduce the cost of locally manufactured goods and services. This will increase the competitiveness of Indian goods and services in the international market and give boost to Indian exports. The uniformity in tax rates and procedures across the country will also go a long way in reducing the compliance cost.

For Central and State Governments –

- Simple and easy to administer: Multiple indirect taxes at the Central and State levels are being replaced by GST. Backed with a robust end-to-end IT system, GST would be simpler and easier to administer than all other indirect taxes of the Centre and State levied so far.

- Better controls on leakage: GST will result in better tax compliance due to a robust IT infrastructure. Due to the seamless transfer of input tax credit from one stage to another in the chain of value addition, there is an inbuilt mechanism in the design of GST that would incentivize tax compliance by traders.

- Higher revenue efficiency: GST is expected to decrease the cost of collection of tax revenues of the Government, and will therefore, lead to higher revenue efficiency.

For the consumers –

- Single and transparent tax proportionate to the value of goods and services: Due to multiple indirect taxes beinglevied by the Centre and State, with incomplete or no input tax credits available at progressive stages of value addition, the cost of most goods and services in the country today are laden with many hidden taxes. Under GST, there would be only one tax from the manufacturer to the consumer, leading to transparency of taxes paid to the final consumer.

- Relief in overall tax burden: Because of efficiency gains and prevention of leakages, the overall tax burden on most commodities will come down, which will benefit consumers.

Question 3. Which taxes at the Centre and State level are being subsumed into GST?

Answer: At the Central level, the following taxes are being subsumed:

a. Central Excise Duty,

b. Additional Excise Duty,

c. Service Tax,

d. Additional Customs Duty commonly known as Countervailing Duty, and

e. Special Additional Duty of Customs.

At the State level, the following taxes are being subsumed:

a. Subsuming of State Value Added Tax/Sales Tax,

b. Entertainment Tax (other than the tax levied by the local bodies), Central Sales Tax (levied by the Centre and collected by the States),

c. Octroi and Entry tax,

d. Purchase Tax,

e. Luxury tax, and

f. Taxes on lottery, betting and gambling.

Question 4. What are the major chronological events that have led to the introduction of GST?

Answer: GST is being introduced in the country after a 13 year long journey since it was first discussed in the report of the Kelkar Task Force on indirect taxes. A brief chronology outlining the major milestones on the proposal for introduction of GST in India is as follows:

a. In 2003, the Kelkar Task Force on indirect tax had suggested a comprehensive Goods and Services Tax (GST) based on VAT principle.

b. A proposal to introduce a National level Goods and Services Tax (GST) by April 1, 2010 was first mooted in the Budget Speech for the financial year 2006-07.

c. Since the proposal involved reform/ restructuring of not only indirect taxes levied by the Centre but also the States, the responsibility of preparing a Design and Road Map for the implementation of GST was assigned to the Empowered Committee of State Finance Ministers (EC).

d. Based on inputs from Govt of India and States, the EC released its First Discussion Paper on Goods and Services Tax in India in November, 2009.

e. In order to take the GST related work further, a Joint Working Group consisting of officers from Central as well as State Government was constituted in September, 2009.

f. In order to amend the Constitution to enable introduction of GST, the Constitution (115th Amendment) Bill was introduced in the Lok Sabha in March 2011. As per the prescribed procedure, the Bill was referred to the Standing Committee on Finance of the Parliament for examination and report.

g. Meanwhile, in pursuance of the decision taken in a meeting between the Union Finance Minister and the Empowered Committee of State Finance Ministers on 8th November, 2012, a ‘Committee on GST Design’, consisting of the officials of the Government of India, State Governments and the Empowered Committee was constituted.

h. This Committee did a detailed discussion on GST design including the Constitution (115th) Amendment Bill and submitted its report in January, 2013. Based on this Report, the EC recommended certain changes in the Constitution Amendment Bill in their meeting at Bhubaneswar in January 2013.

i. The Empowered Committee in the Bhubaneswar meeting also decided to constitute three committees of officers to discuss and report on various aspects of GST as follows:-

(a) Committee on Place of Supply Rules and Revenue Neutral Rates;

(b) Committee on dual control, threshold and exemptions;

(c) Committee on IGST and GST on imports.

j. The Parliamentary Standing Committee submitted its Report in August, 2013 to the Lok Sabha. The recommendations of the Empowered Committee and the recommendations of the Parliamentary Standing Committee were examined in the Ministry in consultation with the Legislative Department. Most of the recommendations made by the Empowered Committee and the Parliamentary Standing Committee were accepted and the draft Amendment Bill was suitably revised.

k. The final draft Constitutional Amendment Bill incorporating the above stated changes were sent to the Empowered Committee for consideration in September 2013.

l. The EC once again made certain recommendations on the Bill after its meeting in Shillong in November 2013. Certain recommendations of the Empowered Committee were incorporated in the draft Constitution (115th Amendment) Bill. The revised draft was sent for consideration of the Empowered Committee in March, 2014.

m. The 115th Constitutional (Amendment) Bill, 2011, for the introduction of GST introduced in the Lok Sabha in March 2011 lapsed with the dissolution of the 15th Lok Sabha.

n. In June 2014, the draft Constitution Amendment Bill was sent to the Empowered Committee after approval of the new Government.

o. Based on a broad consensus reached with the Empowered Committee on the contours of the Bill, the Cabinet on 17.12.2014 approved the proposal for introduction of a Bill in the Parliament for amending the Constitution of India to facilitate the introduction of Goods and Services Tax (GST) in the country. The Bill was introduced in the Lok Sabha on 19.12.2014, and was passed by the Lok Sabha on 06.05.2015. It was then referred to the Select Committee of Rajya Sabha, which submitted its report on 22.07.2015.

Question 5. How would GST be administered in India?

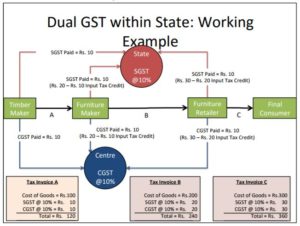

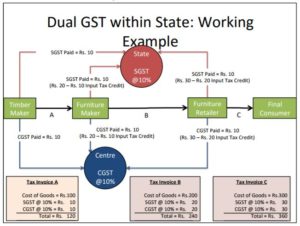

Answer: Keeping in mind the federal structure of India, there will be two components of GST – Central GST (CGST) and State GST (SGST). Both Centre and States will simultaneously levy GST across the value chain. Tax will be levied on every supply of goods and services. Centre would levy and collect Central Goods and Services Tax (CGST), and States would levy and collect the State Goods and Services Tax (SGST) on all transactions within a State. The input tax credit of CGST would be available for discharging the CGST liability on the output at each stage. Similarly, the credit of SGST paid on inputs would be allowed for paying the SGST on output. No cross utilization of credit would be permitted.

Question 6. How would a particular transaction of goods and services be taxed simultaneously under Central GST (CGST) and State GST (SGST)?

Answer : The Central GST and the State GST would be levied simultaneously on every transaction of supply of goods and services except on  exempted goods and services, goods which are outside the purview of GST and the transactions which are below the prescribed threshold limits. Further, both would be levied on the same price or value unlike State VAT which is levied on the value of the goods inclusive of Central Excise.

exempted goods and services, goods which are outside the purview of GST and the transactions which are below the prescribed threshold limits. Further, both would be levied on the same price or value unlike State VAT which is levied on the value of the goods inclusive of Central Excise.

A diagrammatic representation of the working of the Dual GST model within a State is shown.

Question 7. Will cross utilization of credits between goods and services be allowed under GST regime?

Answer : Cross utilization of credit of CGST between goods and services would be allowed. Similarly, the facility of cross utilization of credit will be available in case of SGST. However, the cross utilization of CGST and SGST would not be allowed except in the case of inter-State supply of goods and services under the IGST model which is explained in answer to the next question.

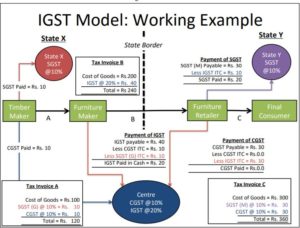

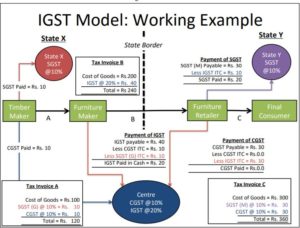

Question 8. How will be Inter-State Transactions of Goods and Services be taxed under GST in terms of IGST method?

Answer: In case of inter-State transactions, the Centre would levy and collect the Integrated Goods and Services Tax (IGST) on all inter- State supplies of goods and services under Article 269A (1) of the Constitution. The IGST would roughly be equal to CGST plus SGST. The IGST mechanism has been designed to ensure seamless. flow of input tax credit from one State to another. The inter-State seller would pay IGST on the sale of his goods to the Central Government after adjusting credit of IGST, CGST and SGST on his purchases (in that order). The exporting State will transfer to the Centre the credit of SGST used in payment of IGST. The importing dealer will claim credit of IGST while discharging his output tax liability (both CGST and SGST) in his own State. The Centre will transfer to the importing State the credit of IGST used in payment of SGST. Since GST is a destination-based tax, all SGST on the final product will ordinarily accrue to the consuming State. A diagrammatic representation of the working of the IGST model for inter-State transactions is shown.

State supplies of goods and services under Article 269A (1) of the Constitution. The IGST would roughly be equal to CGST plus SGST. The IGST mechanism has been designed to ensure seamless. flow of input tax credit from one State to another. The inter-State seller would pay IGST on the sale of his goods to the Central Government after adjusting credit of IGST, CGST and SGST on his purchases (in that order). The exporting State will transfer to the Centre the credit of SGST used in payment of IGST. The importing dealer will claim credit of IGST while discharging his output tax liability (both CGST and SGST) in his own State. The Centre will transfer to the importing State the credit of IGST used in payment of SGST. Since GST is a destination-based tax, all SGST on the final product will ordinarily accrue to the consuming State. A diagrammatic representation of the working of the IGST model for inter-State transactions is shown.

Question 9. How will IT be used for the implementation of GST?

Answer: For the implementation of GST in the country, the Central and State Governments have jointly registered Goods and Services Tax Network (GSTN) as a not-for-profit, non-Government Company to provide shared IT infrastructure and services to Central and State Governments, tax payers and other stakeholders. The key objectives of GSTN are to provide a standard and uniform interface to the taxpayers, and shared infrastructure and services to Central and State/UT governments. GSTN is working on developing a state-of-the-art comprehensive IT infrastructure including the common GST portal providing frontend services of registration, returns and payments to all taxpayers, as well as the backend IT modules for certain States that include processing of returns, registrations, audits, assessments, appeals, etc. All States, accounting authorities, RBI and banks, are also preparing their IT infrastructure for the

administration of GST. There would no manual filing of returns. All taxes can also be paid online. All mis-matched returns would be autogenerated, and there would be no need for manual interventions. Most returns would be self-assessed.

Question 10. How will imports be taxed under GST?

Answer : The Additional Duty of Excise or CVD and the Special Additional Duty or SAD presently being levied on imports will be subsumed under GST. As per explanation to clause (1) of article 269A of the Constitution, IGST will be levied on all imports into the territory of India. Unlike in the present regime, the States where imported goods are consumed will now gain their share from this IGST paid on imported goods.

Question 11. What are the major features of the Constitution (122nd Amendment) Bill, 2014?

Answer : The salient features of the Bill are as follows:

- Conferring simultaneous power upon Parliament and the State Legislatures to make laws governing goods and services tax;

- Subsuming of various Central indirect taxes and levies such as Central Excise Duty, Additional Excise Duties, Service Tax, Additional Customs Duty commonly known as Countervailing Duty, and Special Additional Duty of Customs;

- Subsuming of State Value Added Tax/Sales Tax, Entertainment Tax (other than the tax levied by the local bodies), Central Sales Tax (levied by the Centre and collected by the States), Octroi and Entry tax, Purchase Tax, Luxury tax, and Taxes on lottery, betting and gambling;

- Dispensing with the concept of ‘declared goods of special importance’ under the Constitution;

- Levy of Integrated Goods and Services Tax on inter-State transactions of goods and services;

- GST to be levied on all goods and services, except alcoholic liquor for human consumption. Petroleum and petroleum products shall be subject to the levy of GST on a later date notified on the recommendation of the Goods and Services Tax Council;

- Compensation to the States for loss of revenue arising on account of implementation of the Goods and Services Tax for a period of five years;

- Creation of Goods and Services Tax Council to examine issues relating to goods and services tax and make recommendations to the Union and the States on parameters like rates, taxes, cesses and surcharges to be subsumed, exemption list and threshold limits, Model GST laws, etc. The Council shall function under the Chairmanship of the Union Finance Minister and will have all the State Governments as Members.

Question 12. What are the major features of the proposed registration procedures under GST?

Answer: The major features of the proposed registration procedures under GST are as follows:

i. Existing dealers: Existing VAT/Central excise/Service Tax payers will not have to apply afresh for registration under GST.

ii. New dealers: Single application to be filed online for registration under GST.

iii. The registration number will be PAN based and will serve the purpose for Centre and State.

iv. Unified application to both tax authorities.

v. Each dealer to be given unique ID GSTIN.

vi. Deemed approval within three days.

vii. Post registration verification in risk based cases only.

Question 13. What are the major features of the proposed returns filing procedures under GST?

Answer: The major features of the proposed returns filing procedures under GST are as follows:

a. Common return would serve the purpose of both Centre and State Government.

b. There are eight forms provided for in the GST business processes for filing for returns. Most of the average tax payers would be using only four forms for filing their returns. These are return for supplies, return for purchases, monthly returns and annual return.

c. Small taxpayers: Small taxpayers who have opted composition scheme shall have to file return on quarterly basis.

d. Filing of returns shall be completely online. All taxes can also be paid onine.

Question 14. What are the major features of the proposed payment procedures under GST?

Answer: The major features of the proposed payments procedures under GST are as follows:

i. Electronic payment process- no generation of paper at any stage

ii. Single point interface for challan generation- GSTN

iii. Ease of payment – payment can be made through online banking, Credit Card/Debit Card, NEFT/RTGS and through cheque/cash at the bank

iv. Common challan form with auto-population features

v. Use of single challan and single payment instrument

vi. Common set of authorized banks

vii. Common Accounting Codes

(Complied from the Data available on PIB)

in which India participated on an equal footing.

in which India participated on an equal footing.

exempted goods and services, goods which are outside the purview of GST and the transactions which are below the prescribed threshold limits. Further, both would be levied on the same price or value unlike State VAT which is levied on the value of the goods inclusive of Central Excise.

exempted goods and services, goods which are outside the purview of GST and the transactions which are below the prescribed threshold limits. Further, both would be levied on the same price or value unlike State VAT which is levied on the value of the goods inclusive of Central Excise. State supplies of goods and services under Article 269A (1) of the Constitution. The IGST would roughly be equal to CGST plus SGST. The IGST mechanism has been designed to ensure seamless. flow of input tax credit from one State to another. The inter-State seller would pay IGST on the sale of his goods to the Central Government after adjusting credit of IGST, CGST and SGST on his purchases (in that order). The exporting State will transfer to the Centre the credit of SGST used in payment of IGST. The importing dealer will claim credit of IGST while discharging his output tax liability (both CGST and SGST) in his own State. The Centre will transfer to the importing State the credit of IGST used in payment of SGST. Since GST is a destination-based tax, all SGST on the final product will ordinarily accrue to the consuming State. A diagrammatic representation of the working of the IGST model for inter-State transactions is shown.

State supplies of goods and services under Article 269A (1) of the Constitution. The IGST would roughly be equal to CGST plus SGST. The IGST mechanism has been designed to ensure seamless. flow of input tax credit from one State to another. The inter-State seller would pay IGST on the sale of his goods to the Central Government after adjusting credit of IGST, CGST and SGST on his purchases (in that order). The exporting State will transfer to the Centre the credit of SGST used in payment of IGST. The importing dealer will claim credit of IGST while discharging his output tax liability (both CGST and SGST) in his own State. The Centre will transfer to the importing State the credit of IGST used in payment of SGST. Since GST is a destination-based tax, all SGST on the final product will ordinarily accrue to the consuming State. A diagrammatic representation of the working of the IGST model for inter-State transactions is shown.