Government of India is celebrating the 1st Anniversary of the Goods and Services Tax (GST) coming into force, here tomorrow. GST was launched on the 1st July, 2017 in a majestic ceremony held in the Central Hall of Parliament on the midnight of 30th June, 2017. The first year has been remarkable both for the sheer variety of challenges that its implementation has thrown up and for the willingness and ability of policy makers and tax administrators to rise up to these challenges and respond befittingly.

But more importantly, the first year of GST has been an example to the world of the readiness of the Indian taxpayer to be a partner in this unprecedented reform of Indian taxation. Accordingly, it has been decided that Sunday, the 1st of July, 2018 shall be commemorated as ‘GST Day’. Union Minister for Railways, Coal , Finance & Corporate Affairs Shri Piyush Goyal will preside over as the Chief Guest of the event and Minister of State for Finance, Shri Shiv Pratap Shukla will be the Guest of Honour.

Before implementation of GST, Indian taxation system was a farrago of central, state and local area levies. In the constitutional scheme, taxation power on goods was with Central Government but it was limited up to the stage of manufacture and production while States had power to tax sale and purchase of goods. Centre had the exclusive power to tax services. This sort of division of taxing powers created a grey zone which led to legal disputes since determination of what constitutes a goods or service became increasingly difficult.

In the discussions that preceded amendment in the Constitution for GST, there were a number of thorny issues that required resolution and agreement between Central Government and State Governments. Implementing a tax reform as vast as GST in a diverse country like India required the reconciliation of interests of various States with that of the Centre. Some of these issues included origin-based versus destination-based taxation, rate structure and compensation, Dispute Settlement, inclusion of Alcohol and Petroleum products under GST. Resolution of these issues took some time and finally, the Constitution (122nd Amendment) Bill, 2014 was introduced in the Parliament on 19th December, 2014 and has been enacted as Constitution (101st Amendment) Act, 2016 w.e.f. 16th September, 2016.

As provided for in Article 279A of the Constitution, the Goods and Services Tax Council (the Council) was notified with effect from 12th September, 2016. The Council is comprised of the Union Finance Minister (who is the Chairman of the Council), the Minister of State (Revenue) and the State Finance/Taxation Ministers as members and is empowered to make recommendations to the Union and the States on all GST related issues. The Council has met for 27 times and no occasion has arisen so far that required voting to decide any matter. All the decisions have been taken by consensus. This is a fitting tribute to the spirit of cooperative federalism which has prevailed throughout all Centre-State interactions in relation to all aspects of GST.

Four Laws namely CGST Act, UTGST Act, IGST Act and GST (Compensation to States) Act were passed by the Parliament and since been notified on 12th April, 2017. All the other States (except Jammu & Kashmir) and Union territories with legislature have passed their respective SGST Acts. The economic integration of India was completed on 8th July, 2017 when the State of J&K also passed the SGST Act and the Central Government also subsequently extended the CGST Act to J&K. On 22nd June, 2017, the first notification was issued for GST and notified certain sections under CGST Act. Since then, one hundred and three notifications under CGST Act have been issued notifying sections, notifying rules, amendment to rules and for waiver of penalty, etc. Thirteen, twenty eight and one notifications have also been issued under IGST Act, UTGST Act and GST (Compensation to States) Act respectively. Further 59, 63, 59 and 8 rate related notifications each have been issued under the CGST Act, IGST Act, UTGST Act and GST (Compensation to States) Act respectively. Similar notifications have been issued by all the States under the respective SGST Act. Apart from the notifications, 53 circulars and 14 orders have also been issued by CBIC on various subjects like proper officers, ease of exports, and extension of last dates for filling up various forms, etc.

India has adopted dual GST model because of its unique federal nature. Under this model, tax is levied concurrently by the Centre as well as the States on a common base, i.e. supply of goods or services or both. GST to be levied by the Centre would be called Central GST (Central tax / CGST) and that to be levied by the States would be called State GST (State Tax / SGST). State GST (State Tax / SGST) would be called UTGST (Union territory tax) in Union Territories without legislature. CGST & SGST / UTGST shall be levied on all taxable intra-State supplies. Inter-State supply of goods or services shall be subjected to Integrated GST (Integrated tax / IGST). The IGST model is a unique contribution of India in the field of VAT. The IGST Model envisages that Centre would levy IGST (Integrated Goods and Service Tax) which would be CGST plus SGST on all inter-State supply of goods or services or both.

The introduction of e-way (electronic way) bill is a monumental shift from the earlier ‘Departmental Policing Model’ to a ‘Self-Declaration Model’. It envisages one e-way bill for movement of the goods throughout the country, thereby ensuring a hassle free movement of goods throughout the country. The e-way bill system has been introduced nation-wide for all inter-State movement of goods with effect from 1st April, 2018. As regards intra-State movement of gods, all States have notified e-way bill rules for intra-State supplies last being NCT of Delhi where it was introduced w.e.f. 16th June, 2018.

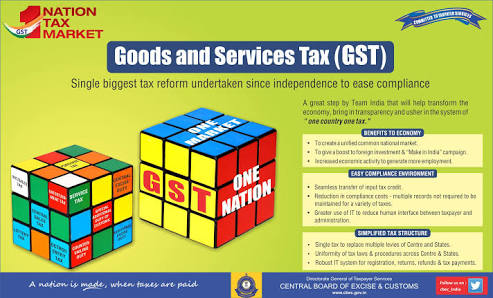

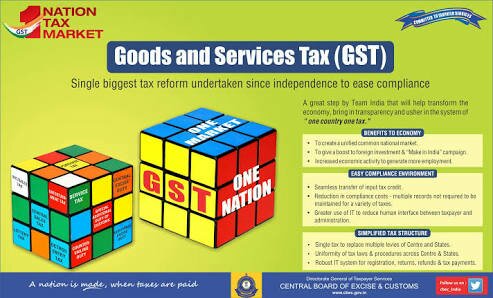

GST will have a multiplier effect on the economy with benefits accruing to various sectors such as exporters, small traders and entrepreneurs, agriculture and industry, common consumers. GST has already promoted ‘Make in India’ and has improved the ‘Ease of Doing Business’ in India. By subsuming more than a score of taxes under GST, the road to a harmonized system of indirect tax has been paved making India an economic union.

Any new change is accompanied by difficulties and problems at the outset. A change as comprehensive as GST is bound to pose certain challenges not only for the government but also for business community, tax administration and even common citizens of the country. Some of these challenges relate to the unfamiliarity with the new regime and IT systems, legal challenges, return filing and reconciliations, passing on transition credit. Many of the processes in the GST are new for small and medium enterprises in particular, who were not used to regular and online filing of returns and other formalities.

Based on the feedback received from businesses, consumers and taxpayers from across the country, attempt has been made to incorporate suggestions and reduce problems through short-term as well as long-term solutions. National Anti-Profiteering Authority has initiated investigation into various complaints of anti-profiteering and has passed orders in some cases to protect consumer interest. To expedite sanction of refund, manual filing and processing of refunds has been enabled. Clarificatory Circulars and notifications have been issued to guide field formations of CBIC and States in this regard. The government has put in place an IT grievance redressal mechanism to address the difficulties faced by taxpayers owing to technical glitches on the GST portal.

The introduction of GST is truly a game changer for Indian economy as it has replaced multi-layered, complex indirect tax structure with a simple, transparent and technology–driven tax regime. It will integrate India into a single, common market by breaking barriers to inter-State trade and commerce. By eliminating cascading of taxes and reducing transaction costs, it will enhance ease of doing business in the country and provide an impetus to ‘Make in India’ campaign. GST will result in ‘ONE NATION, ONE TAX, ONE MARKET’. (Information compiled from the source PIB)

in which India participated on an equal footing.

in which India participated on an equal footing.